Gifts that reduce taxes

Impact of CARES Act on fundraising and nonprofits

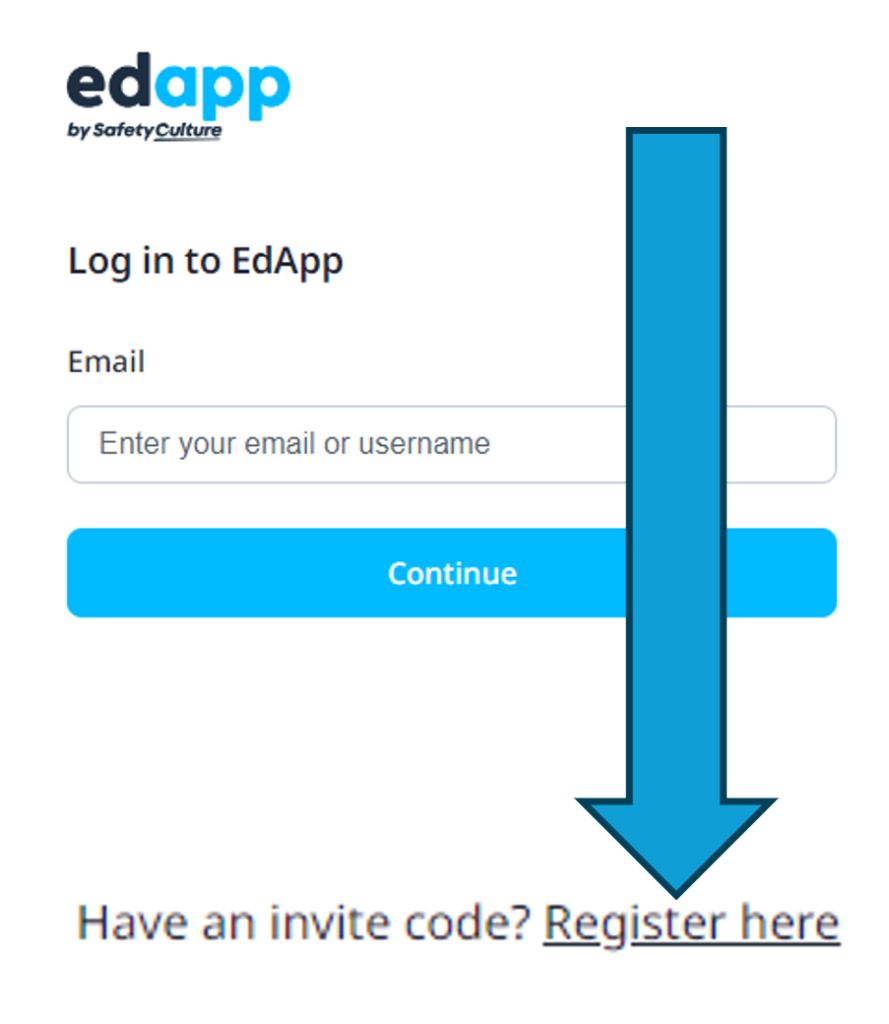

How the CARES Act impacts donors and charitable giving in 2020

Universal charitable deduction for donors who do not itemize

Donors who do not itemize can deduct cash gifts to public charities of up to $300 per taxpayer or $600 per married couple.

Cash gifts include those made by check, credit card, electronic funds transfer, or payroll deduction.

Increase in AGI limit for donors who itemize

Donors who itemize can deduct cash gifts to public charities of up to 100% of their adjusted gross income (AGI). While this

deduction is reduced by other itemized deductions, any unused deduction can be carried over for up to five additional years.

Increase in limit on cash contributions from corporations

Corporations can give up to 25% of taxable income in 2020 for cash gifts to public charities. While other charitable

contributions reduce this limit dollar-for-dollar, cash contributions more than the 25% limit can be carried over for

up to five additional years.

Suspension of Required Minimum Distributions (RMD)

The CARES Act suspends RMD for 2020 from IRAs, 401(k)s, 403(b)s and other defined benefit pension plans. This change

helps retirees who would have had to take larger-than-expected distributions or face penalties.

IRA “Rollover” gifts & IRA gifts by designation

IRA “Rollover” gifts allow donors, 70 ½ or older, to use IRA assets to make charitable gifts. IRA Rollover gifts are immediate distributions from a donor’s IRA account made directly to charity – that count toward a donor’s required minimum distribution or RMD. By reducing taxable income, IRA Rollover gifts can lower a donor’s tax bill and may help donors avoid Medicare high-income surcharges. And, as IRA Rollover gifts pass tax-free to qualified public charities, 100% of your gift to Catholic Charities can be used to help our brothers and sisters in the Bay Area.

To make the process of giving from your IRA easy, we have an online resource that allows you to give from your IRA to Catholic Charities. Or, if you would prefer to complete the gift offline, you can download the forms you need. This resource works with all major IRA custodians. Give from your IRA today.

As retirement assets are taxed differently, IRA’s left to loved ones can actually become a tax liability. Leaving some or all of your IRA to a good cause, like Catholic Charities, and other, less tax-vulnerable assets to family or friends can reduce this liability for your loved ones. Simply ask your plan administrator for a beneficiary designation form and include Catholic Charities to receive a specific percentage of your account or as a contingent beneficiary.

Gifts of appreciated stock

When you donate appreciated stock, bonds or mutual funds you’ve owned for more than a year, you’ll receive a tax deduction for the fair market value and avoid capital gains tax. Your deduction may provide you with additional tax savings if you itemize.

If you use appreciated stock to fund a charitable gift annuity or charitable trust, you won’t owe capital gains tax when those assets are sold – and you’ll receive an immediate tax deduction – while creating a stream of income for yourself and/or your loved ones.