Important Notice: Beware of Scams

Catholic Charities San Francisco (CCSF) does not charge fees over the phone or through online ads. If you are contacted by someone claiming to be Catholic Charities and asking for payment, it is a scam. Please call our office directly at (415) 972-1200 for more information or to request a consultation.

Important Notice:

Beware of Scams

Catholic Charities San Francisco (CCSF) does not charge fees over the phone or through online ads. If you are contacted by someone claiming to be Catholic Charities and asking for payment, it is a scam. Please call our office directly at (415) 972-1200 for more information or to request a consultation.

- Who We Are

- What We Do

- Advocacy

- Disaster Readiness

- Aging Support Services

- Immigration

- Youth & Child Development

- Homelessness & Housing

- 10th & Mission Family Housing

- Assisted Housing & Health

- Bayview Access Point

- Carmelita Women’s Home

- Derek Silva Community

- Edith Witt Senior Community

- Homelessness Prevention Program

- Mission Access Point

- Peter Claver Community

- Rita da Cascia Community

- SF HOME

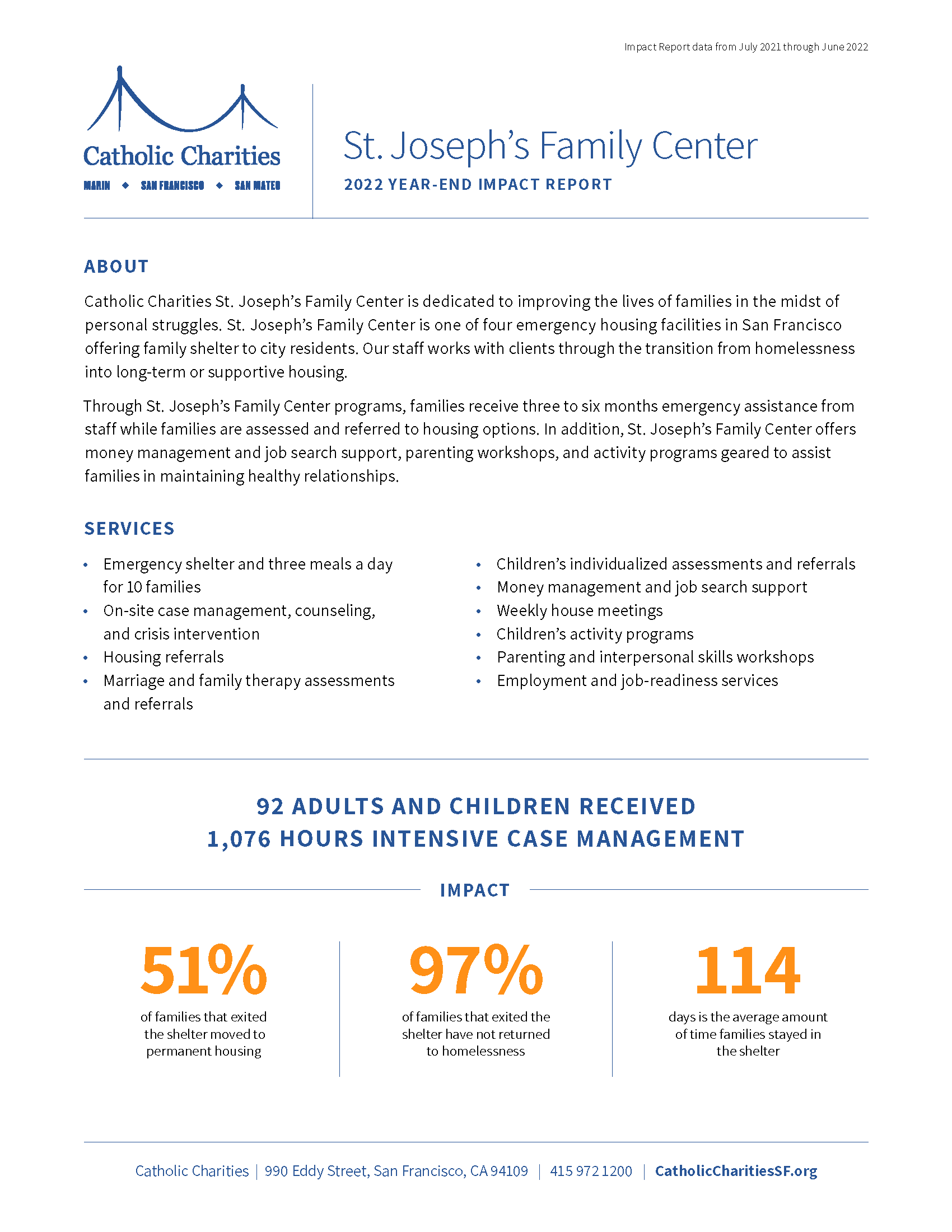

- St. Joseph’s Family Center

- Treasure Island Supportive Housing

- How to Help

- News & Events

- Our Stories

(415) 972-1200

- Who We Are

- What We Do

- Advocacy

- Disaster Readiness

- Aging Support Services

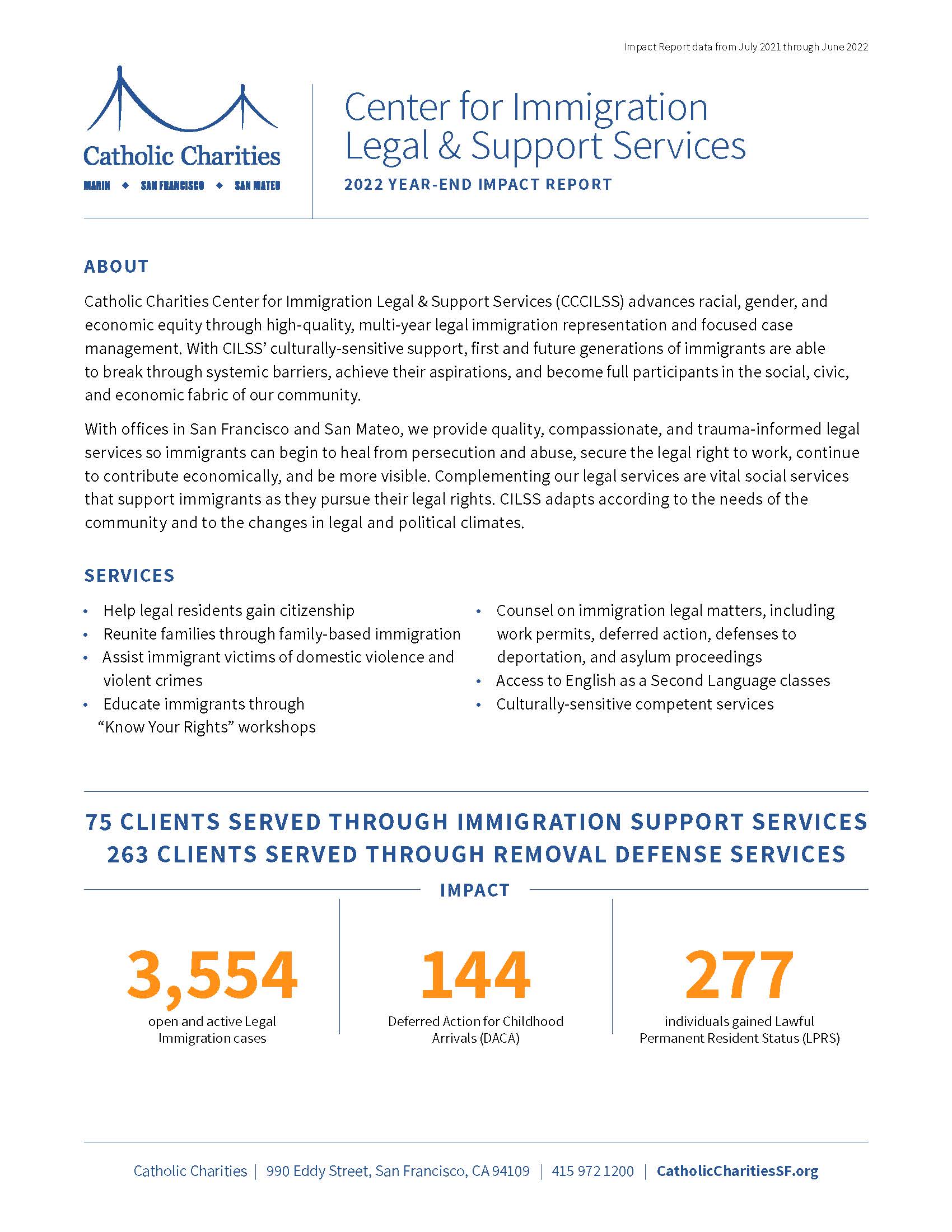

- Immigration

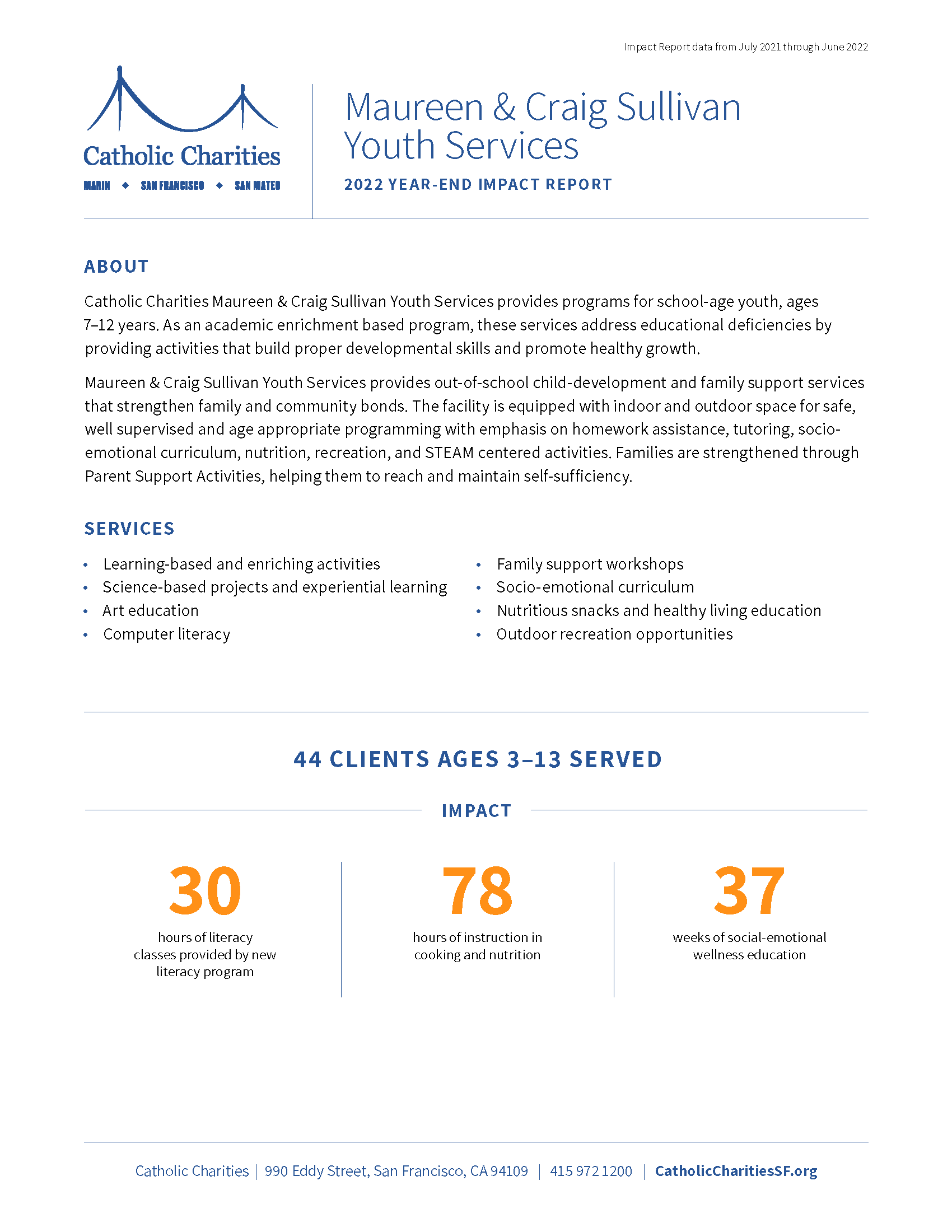

- Youth & Child Development

- Homelessness & Housing

- 10th & Mission Family Housing

- Assisted Housing & Health

- Bayview Access Point

- Carmelita Women’s Home

- Derek Silva Community

- Edith Witt Senior Community

- Homelessness Prevention Program

- Mission Access Point

- Peter Claver Community

- Rita da Cascia Community

- SF HOME

- St. Joseph’s Family Center

- Treasure Island Supportive Housing

- How to Help

- News & Events

- Our Stories

MARIN | SAN FRANCISCO | SAN MATEO